What is Skrill?

Skrill, formerly known as Moneybookers, is an international payment processing service that allows merchants to sell and receive payments online, and users to receive and transfer money. It is one of the most widely used online payment processors.

Skrill has progressively made digital payments simple, quick and secure since their establishment in 2001. They have been recognized globally for their payment solutions for both business and pleasure, including where deposits and withdrawals are made for gaming sites.

The company headquarters are based in London, and their offices are spread across Europe and the USA. They boast more than 500 employees from over 30 countries.

2001

Started as Moneybookers and was later rebranded as The Skrill Group

2002

Moneybookers.com was launched and initiated their first move towards helping their customers send money online with just an email and a password.

Became the first FCA regulated e-money company.

2007

Investcorp Technology Partners complete their Moneybookers buyout.

2009

Links up with eBay.

2010

Rebranding to Skrill starts as a way of improving their Moneybookers global payment network.

This rebranding is said to be UK’s fastest growing private equity-backed company in the Sunday Times Deloitte League Buyout Track 100 table

2011

After payolution becomes part of Skrill Group, they start the Pay by Invoice and Pay by Instalment options.

2012

Skrill 1-Tap – a market leading single click payment platform – allows optimal conversion and mobile friendly transactions.

2013

Acquire Paysafecard, which is Europe’s leader in online prepaid payment providers and becomes the preferred choice for online payments.

2014

Acquire Ukash, which further enhances their position in Europe’s prepaid online marketplace.

Today

Skrill is trusted by millions for all kinds of online global payments. They currently make their payments secure, simple and quick, with a presence in more than 200 countries, and supporting over 40 currencies.

How safe is Skrill in 2024?

Skrill (Moneybookers) is a recognized online payment provider, regulated by the FCA. All payments are made using safe servers and state of the art encryption. Being in the business for over 13 years, Skrill has shown maximum effort and diligence to keep their customers’ money and data safe at all times. Over 36 million account holders already trust Skrill to send and receive money worldwide in 200 countries and 40 currencies, securely and at low costs, without revealing any personal financial details. As a VIP client, you can even use an RSA Token to log in as an additional layer of security for your account.

Your information is not shared with retailers. All that’s needed is your email address and password. Your banking information is never revealed. This information is encrypted in the highest standards of Payment Card Industry Data Security Standards (PCI-DSS Level 1), so your information cannot be read.

Skrill’s security page offers appropriate advice on the subject, and your details and password will never be requested.

Two Factor Authenticator

Skrill understands that security is a chief priority and features Google Authenticator for an extra layer of protection. The two-factor authentication needs you to enter a code from your phone, along with your email address and password.

What are the other benefits?

You can shop online using your account, and can also order a MasterCard which will be connected to your online account and can be used to pay for goods and services on and offline. You can also withdraw your money at all ATMs that accept MasterCard. As a Skrill user, you are able to have VIP status, giving you higher withdrawal limits, lower fees, the MasterCard for free and even cashback on all your transactions.

Skrill’s VIP programme comes with more benefits, such as performing transactions at lower fees, 24/7 support and access to special promotions and additional security services.

With the programme you will be joining an exclusive club where you have higher limits to your account both online and offline. You also receive guaranteed fraud protection which entitles you to up to 100% of your money back.

There are four levels of the VIP programme: Bronze, Silver, Gold, and Diamond. In this review, we will only mention the amount you get to transact at each level.

Bronze: Over €6,000 per quarter

Silver: €15,000 per quarter

Gold: €45,000 per quarter

Diamond: €90,000 per quarter

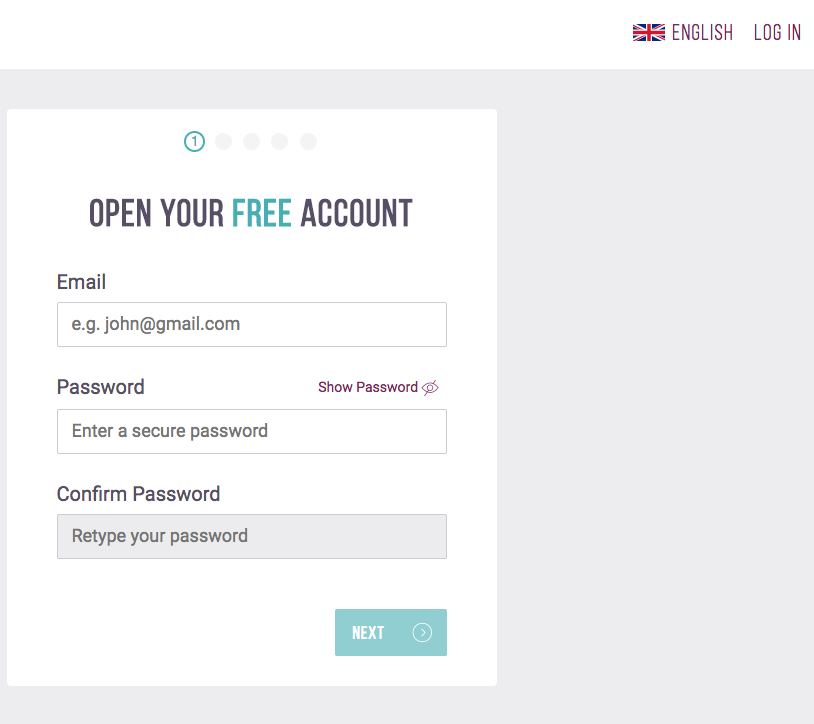

How do I register?

Signing up with Skrill is easy. Simply follow the steps below:

- Click on the Create a Skrill Account button and you will be redirected to Skrill’s main page.

- Go to Register on the top right.

- Enter your personal information.

- Once you’ve done that, your account is ready.

- Make a deposit into your account using one of the many methods offered. A deposit of €10 is enough.

- You’ll need to verify your Skrill account by going to Verify Account and sending a copy of your ID card/passport and a current proof of address. The whole process is very simple and every step is explained in your account. You can use your account before verification, but only up to a certain limit, so you should complete verification as soon as possible to increase your account limits.

The Skrill Prepaid MasterCard

The MasterCard is a stamped plastic card that you can order once your Skrill account has been successfully verified. With this card you will have immediate access to your balance, and can withdraw money at almost every ATM around the world. Of course, you can also pay with the card in both high street and online shops where MasterCard is accepted. Since the card is highly embossed, it looks like a real credit card, but note that it is prepaid, so only the amount that is available in your account can be used.

There is a €10 annual fee for the Prepaid Mastercard (N.B. it’s free for VIPs).

Should you withdraw money from an ATM you will incur a fee of 1.75%, whether it be Germany, Spain or anywhere else in the world. The use of the card in stores or for online shopping is basically free as long as it is the same currency that corresponds to your Skrill account. If you pay in a currency other than your account, up to 3.79% exchange fees will apply, depending on your VIP status.

For more information regarding limits and fees see the following table:

VIP Program

The VIP program is fantastic as it eliminates almost all fees. To attain VIP status you have to reach a certain turnover volume with respect to deposits to merchants such as online poker, casino and sports betting providers. Since you as a customer do not incur any fees for a deposit/withdrawal, it is advisable to make numerous deposits and cashouts in order to enjoy a better VIP status and its associated benefits.

Here is an overview of the benefits and terms of the Skrill VIP programme: